As a Sales Executive at Mac-Tech, I’ve spent years working with businesses across the Midwest, helping them navigate the complexities of equipment investments. My focus has always been on understanding real-world fabrication challenges and providing solutions that drive efficiency and profitability. With the current tax incentives and looming tariff threats, now is the perfect time to invest wisely in new machinery.

Maximize Your Tax Savings with Strategic Equipment Purchases

Time is of the essence when it comes to making strategic equipment investments. The recent expansion of Section 179 allows businesses to deduct up to $2.5 million on qualifying equipment purchases for 2025. This means you can offset your taxable income significantly, freeing up capital for other business needs. By acting now, you can ensure that your investment stays below the $4 million phase-out threshold, maximizing your deduction potential.

Leverage Section 179 to Enhance Your Bottom Line

Understanding the specifics of Section 179 is crucial for making the most of this opportunity. If your equipment spend exceeds $2.5 million but remains under $4 million, you can still benefit from a 60% bonus depreciation on the remaining amount. This allows you to spread out the tax benefits over the coming years while still enjoying substantial immediate deductions.

To make the most of these benefits, consider investing in high-quality machinery such as CNC machines, lasers, and presses. These assets not only qualify for deductions but also enhance your operational efficiency, allowing you to stay ahead of the competition.

Act Now to Avoid Rising Costs from Impending Tariffs

The threat of 100% tariffs on imported machinery is real and could significantly impact your acquisition costs. While no definitive implementation date has been set, the risk is enough to warrant immediate action. By securing your equipment now, you lock in current prices and take advantage of the available tax deductions before potential tariff increases.

HYDMECH CSNC-65

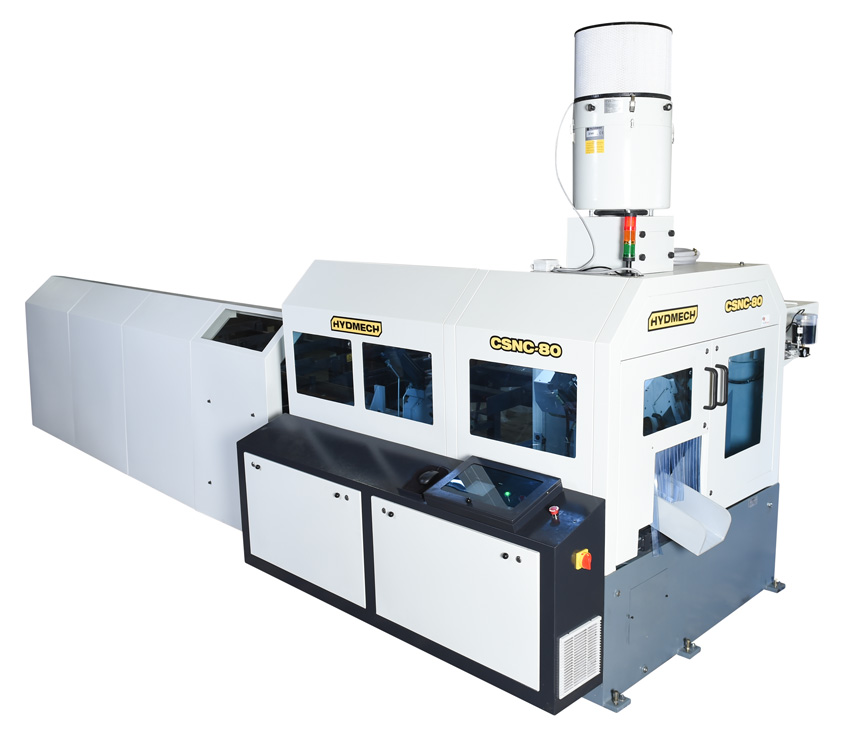

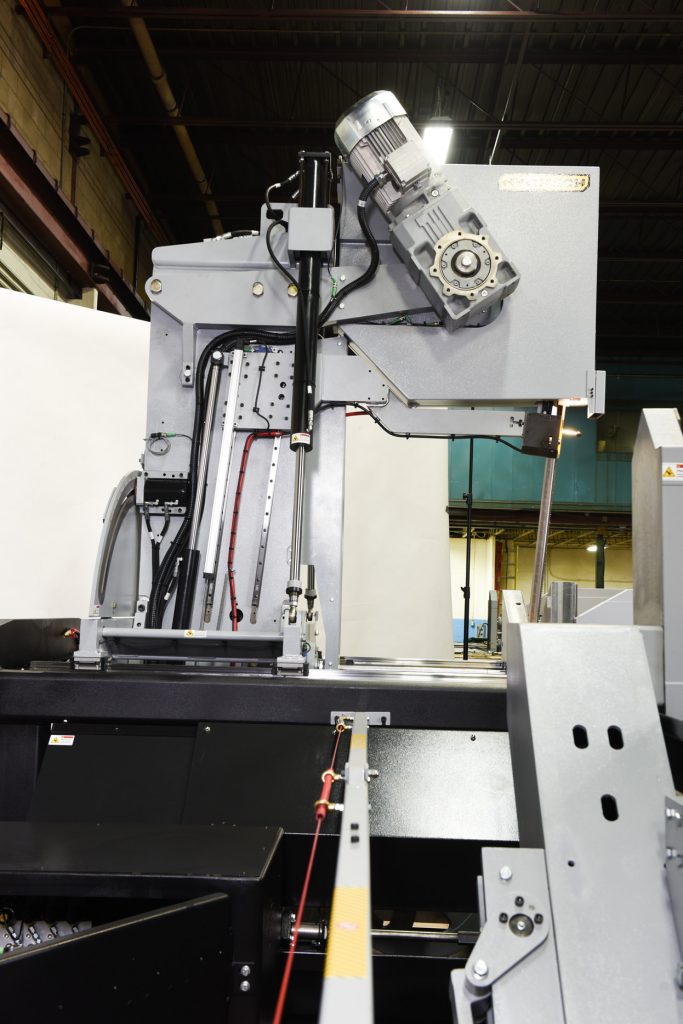

HYDMECH CSNC-80

Gain a Competitive Edge with State-of-the-Art Machinery

Investing in cutting-edge technology like the PCR41 Robotic Plasma Cutting System can revolutionize your production process. This machine combines robotics, vision systems, and plasma torch technology to deliver unmatched speed, precision, and efficiency. By automating cutting operations, the PCR41 reduces manufacturing costs and minimizes material handling, giving you a competitive edge in the market.

Partner with Mac-Tech for Tailored Investment Solutions

At Mac-Tech, we understand that each business has unique needs. That’s why we offer tailored solutions to help you finance your equipment purchases. Our partnership with Tech Financial provides flexible payment plans and quick credit approvals, allowing you to preserve working capital while accessing the latest technology.

Our team is here to support you every step of the way, from selecting the right machinery to ensuring a seamless financing process. With our expertise, you can invest confidently in your business’s future.

FAQ Section:

What are the benefits of Section 179?

Section 179 allows for immediate deduction of up to $2.5 million on qualifying equipment, reducing taxable income.

How can I avoid the impact of proposed tariffs?

Act quickly to purchase equipment before tariffs are implemented, securing current prices and deductions.

What makes the PCR41 a smart investment?

The PCR41 offers advanced automation, precision, and reduced material handling, enhancing operational efficiency.

How does Mac-Tech assist with financing?

We provide tailored financing solutions through Tech Financial, offering flexible plans and quick approvals.

Why should I invest in new machinery now?

Current tax incentives and potential tariff increases make now the ideal time to invest, maximizing savings and efficiency.

If you have further questions or need sales support, please feel free to reach out. I’m here to help you make the best investment for your business.

Get Weekly Mac-Tech News & Updates