As a Sales Executive at Mac-Tech, I’ve spent years working with fabricators across the Midwest. My focus is on solving real-world challenges with practical, effective solutions. I understand the unique demands of the industry and know how crucial it is to stay ahead of the competition. Let’s dive into how Minnesota fabricators can leverage tube laser technology and tax incentives to boost their operations.

Explore Advanced Tube Laser Technology for Competitive Edge

In today’s competitive market, having the right technology can set you apart. Advanced tube laser systems offer precision and efficiency that traditional methods simply can’t match. By integrating these systems, fabricators can handle complex structural jobs with ease, reducing the chance of errors and improving overall quality.

When considering tube laser power levels, it’s essential to assess your specific needs. For instance, if you’re frequently working with thicker materials, a higher power laser will provide the necessary cutting capability. Our recommendation is to look into systems like the BLM GROUP LT7, known for its versatility and precision in handling diverse materials.

Maximize ROI Through Strategic Year-End Equipment Upgrades

Investing in new equipment can be a significant expense, but timing your purchases strategically can maximize your return on investment. By upgrading before year-end, you can take full advantage of tax benefits while positioning your business for future growth.

Planning these upgrades involves understanding your current production capabilities and identifying areas where new technology can fill gaps. Consider the logistical aspects of installation and integration into your existing workflow. A well-planned upgrade minimizes downtime and ensures a smooth transition to enhanced production capabilities.

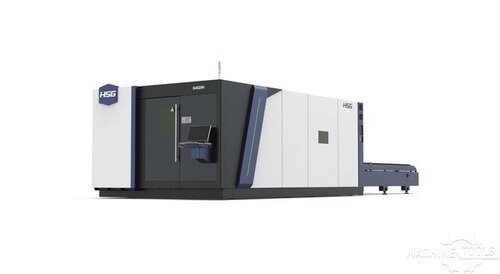

HSG 3015H 12KW

HSG-G3015H V2.0-STORE PRO3015 10 SHELF

Leverage Section 179 Deductions for Immediate Financial Benefits

One of the most compelling reasons to invest now is the Section 179 deduction, which allows businesses to expense the full cost of qualifying equipment in the year of purchase. This means that if you act before December 31st, you can deduct the entire cost from your 2025 taxes, providing immediate financial benefits.

Understanding the specifics of Section 179 can be complex, but it’s a powerful tool for managing your business’s financial health. By reducing your taxable income, you can free up capital for other investments or operational needs, making your business more agile and responsive.

Enhance Operational Efficiency with Cutting-Edge Fabrication Solutions

The right tube laser system doesn’t just cut metal; it transforms your entire production process. By reducing material handling and streamlining assembly, these systems improve efficiency and reduce waste. This means faster turnaround times and lower labor costs, directly impacting your bottom line.

Consider machines that offer automated loading and unloading features, as they can significantly reduce manual handling. Systems like the Mazak Fabri Gear MKII are designed with automation in mind, ensuring that your team can focus on higher-value tasks rather than repetitive manual labor.

Drive Business Growth with Tailored Laser Power Investments

Investing in the right laser power level is crucial for supporting your business growth. By tailoring your equipment to your specific needs, you can take on more complex projects and expand your service offerings. This not only attracts new clients but also strengthens relationships with existing ones by delivering superior quality and precision.

Evaluate your current and projected workloads to determine the optimal laser power for your operations. Investing in scalable systems ensures you can adapt to increasing demands without the need for frequent upgrades, providing long-term value and stability.

FAQ

What are the main benefits of upgrading to a tube laser system?

Enhanced precision, reduced material handling, and faster production times.

How does Section 179 affect my purchasing decision?

It allows you to deduct the full cost of the equipment, reducing your taxable income and freeing up capital.

What should I consider when choosing a laser power level?

Consider the thickness and type of materials you work with, as well as your production volume.

Are there specific models you recommend?

The BLM GROUP LT7 and Mazak Fabri Gear MKII are excellent choices for versatile and automated operations.

How can laser technology improve my workflow?

By automating processes and reducing manual labor, leading to increased efficiency and lower costs.

If you have any questions or need assistance with your equipment needs, feel free to reach out. I’m here to help you find the best solutions for your business.

Get Weekly Mac-Tech News & Updates